Exactly How a Debt Management Plan Singapore Can Assist You Achieve Financial Liberty

Exactly How a Debt Management Plan Singapore Can Assist You Achieve Financial Liberty

Blog Article

Proven Techniques for Establishing a Tailored Financial Obligation Administration Strategy to Achieve Financial Flexibility

In the quest for financial liberty, the importance of a well-crafted financial obligation administration strategy can not be overstated. From evaluating your existing economic standing to discovering and establishing possible objectives consolidation choices, each step plays an essential role in assisting you in the direction of your utmost economic objectives.

Assessing Your Current Financial Scenario

Evaluating your present monetary standing is an essential initial action towards attaining lasting financial security and flexibility. By performing a thorough assessment of your income, properties, liabilities, and expenses, you can get a clear understanding of your general economic wellness.

Additionally, it is necessary to analyze your assets, such as financial savings accounts, retirement funds, and residential property, as well as any type of arrearages, including charge card lendings, mortgages, and balances. Determining your internet well worth by subtracting your obligations from your possessions supplies a photo of your monetary placement. This thorough assessment establishes the structure for developing a tailored financial obligation monitoring plan tailored to your specific monetary conditions.

Setting Realistic Financial Debt Repayment Goals

To achieve economic flexibility, establishing sensible debt payment purposes is important for people looking for to reclaim control of their financial resources. Setting reasonable financial debt settlement goals entails a tactical strategy that takes into consideration both lasting and short-term financial targets. debt management plan singapore. Begin by reviewing your present economic situation, consisting of complete financial debt quantities, rate of interest, and monthly income. With this information, prioritize financial debts based on aspects such as rate of interest rates, outstanding balances, and lender terms.

When setting debt settlement goals, it is essential to be specific, measurable, attainable, appropriate, and time-bound (SMART) As an example, purpose to settle a certain quantity of financial debt within a certain duration, such as minimizing charge card financial obligation by $5,000 within the following 6 months. Breaking down bigger objectives right into smaller sized landmarks can assist track progress and maintain inspiration.

Furthermore, consider changing your investing habits to allot even more funds in the direction of financial obligation settlement. Developing a budget that details costs and earnings can highlight locations where financial savings can be made to speed up debt benefit. Frequently evaluating and readjusting your debt settlement goals as required will certainly ensure continued progression towards economic freedom.

Developing a Personalized Budget Strategy

Discovering Debt Combination Approaches

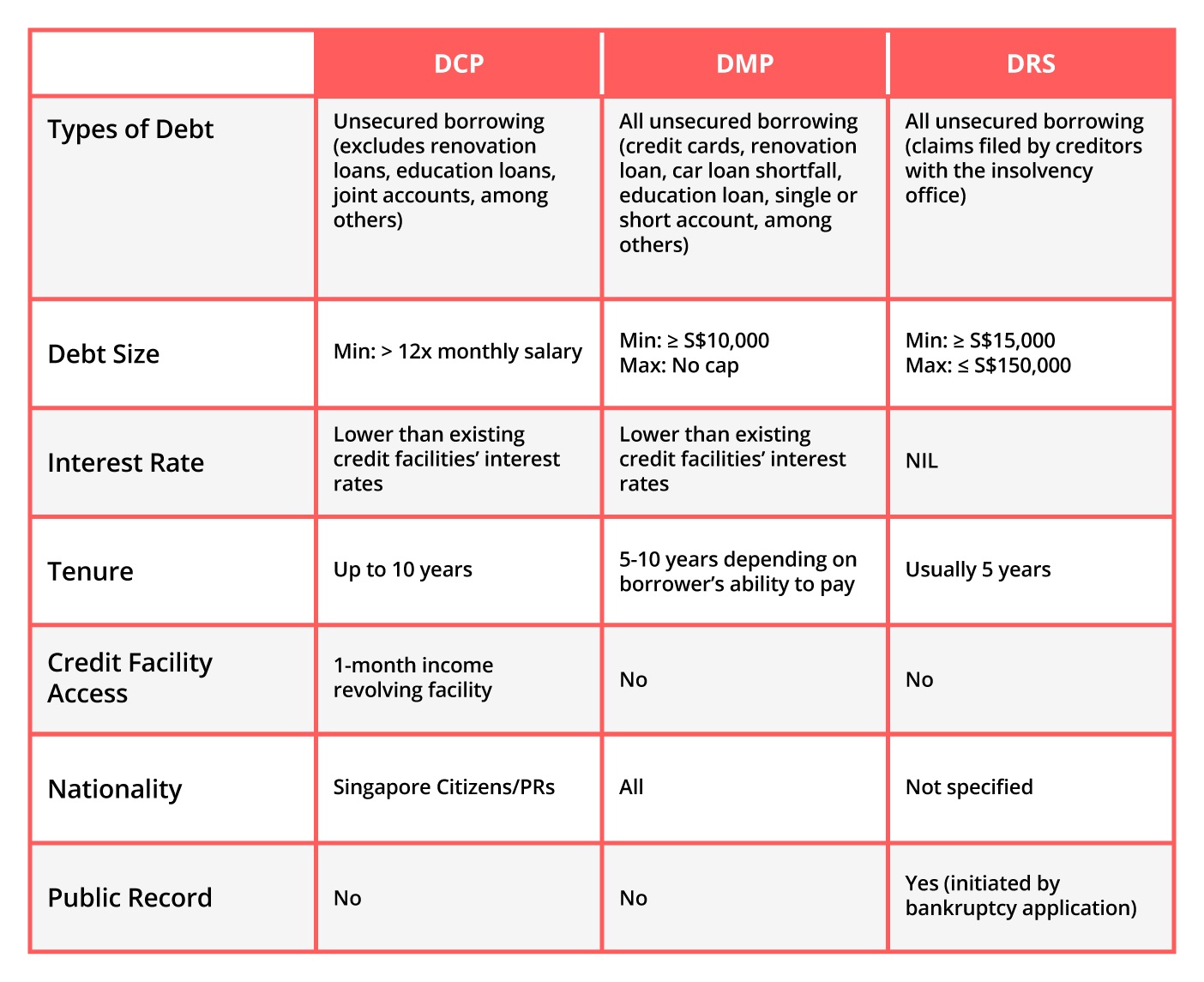

When considering financial obligation loan consolidation techniques, it is very important to evaluate the various choices offered to identify one of the most ideal approach for your financial conditions. Debt loan consolidation includes incorporating several financial obligations right into a solitary car loan or layaway plan, frequently with a lower rates of interest, to make it extra convenient to repay. One typical technique is to get a loan consolidation funding from a banks to settle all existing financial debts, leaving just one month-to-month repayment to concentrate on.

Another technique is financial obligation administration with a debt counseling agency. These agencies deal with lenders to discuss lower rate of interest or month-to-month payments in your place. debt management plan singapore. Nevertheless, it's essential to study and choose a trustworthy company to stay clear of rip-offs or additional financial troubles

Discovering financial debt combination approaches permits people to simplify their debt settlement, potentially reduce interest costs, and work towards economic freedom.

Surveillance and Adjusting Your Strategy

Maintaining an attentive eye on your debt management technique is important for long-lasting financial success. On a regular basis checking your plan enables you to track your progress, determine any deviations from the initial strategy, and make essential changes to remain on program towards achieving your monetary goals.

Life situations, economic concerns, and unexpected costs can all impact your financial obligation monitoring technique. Remember, a dynamic and responsive technique to tracking and changing your financial obligation monitoring strategy is vital to long-lasting economic security.

Verdict

In conclusion, establishing a tailored debt administration plan is necessary for accomplishing financial freedom. By assessing your existing financial scenario, setting sensible financial obligation payment objectives, developing a customized budget plan, exploring financial debt combination approaches, and tracking and changing your plan as required, you can properly manage your financial debts and work towards a debt-free future. It is important to focus on economic security and make notified decisions to enhance your total monetary wellness.

In the pursuit for monetary freedom, the value of a well-crafted debt monitoring strategy can not be overstated. By sticking to a personalized budget plan, individuals can take control Bonuses of their financial circumstance, minimize debt, and development in the direction of economic freedom.

Keep in mind, a responsive and vibrant technique to monitoring and readjusting your financial debt monitoring plan is crucial to lasting economic stability.

In conclusion, developing a tailored debt administration plan is crucial for attaining economic liberty. By analyzing your existing financial circumstance, establishing reasonable debt payment goals, producing a customized budget plan, discovering financial debt loan consolidation approaches, and tracking and readjusting your strategy as required, you can successfully manage your financial obligations and job in the direction of a debt-free future.

Report this page